How to spot a Phone Scam

Older adults are often victims of phone scams. Here are some simple rules to follow to avoid being scammed.

A Noida-based elderly couple lost Rs 8 lakh to cyber fraud in January; a 74-year-old from Haryana lost 11 lakhs. News headlines are filled with phone scams that are on the rise, with older adults as the victims. Even if you are a tech-savvy older adult, the con jobs are done in a way that can dupe anyone. Here are some simple, smart, easy-to-follow tips from Lavanya Mohan that apply to all ages. Stay alert and stay safe.

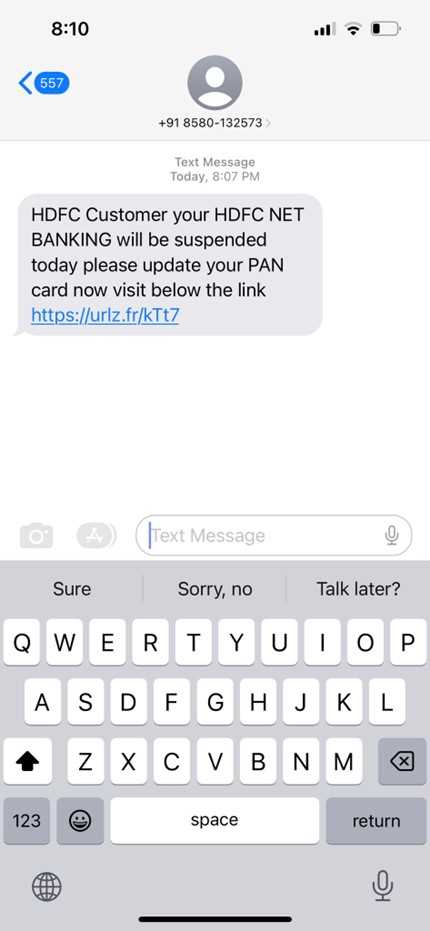

· Scammers usually text/WhatsApp/call, claiming to be from some essential service - the bank, a credit card company, the electricity board, or the telephone network.

· Scam messages & calls are vague. For example, you might get a text that says: "electricity bill for the past month is due" or "phone bill not paid this month". However, there'll be no detail about the date the amount is due or the billing month. That's a red flag.

· If the message feels like it could have been sent to anyone and not specific to you, then you know it's a scam.

· If the person you contact from the text is very pushy and insists that you do what they tell you to, it's a scam. Don't even think twice. Instead, call them out by asking for more details and saying you'll go to the bank or office (e.g., electricity board) and settle things in person. Chances are the phone would be disconnected.

· If the person on the call requires you to download an app, say no. Scammers ask users to download the equivalent of remote desktop access apps (like TeamViewer) to gain access to bank passwords and credit card details.

· It's tough to get your money back, even if you lodge police complaints because scammers use technology to make their numbers impossible to trace. So be suspicious and always check.

· Phishing and banking scams have become highly tech-savvy and convincing. A recent scam shares a link to a very convincing page simulating HDFC bank. Remember that no bank will send you links. Everything they want you to do will be through the bank-verified app or relationship manager-led. If you get a text with a link, no matter how threatening, speak to your Relationship Manager before you click.

· In this text, the scammers got the bank right. But if you are a careful observer, there are some tells in how the message is worded with minor grammatical; errors:

1. There's no "Dear customer", which is how the bank usually sends me texts.

2. "Below the link" and not the link below.

3. Threat of immediate suspension. That's the biggest tell.

· Remember, no bank can suspend anything overnight unless government authorities demand it, and even that involves due process.

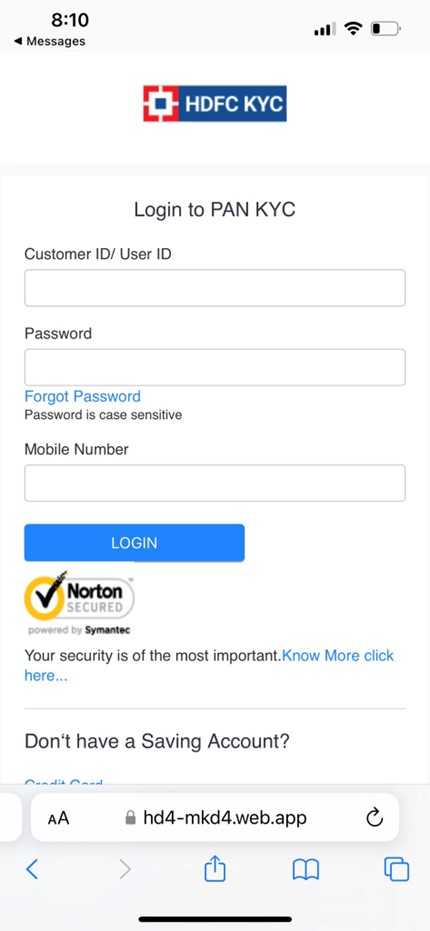

· If you click on the link, the landing page that opens is very convincing (see image below). The scam is to capture your credentials + PAN Card. Can you imagine what they can get away with if they have both?

· What are the suspicious parts in the image? 1. Check the URL. It should be that of HDFC bank, which it's not. 2. It says HDFC KYC (not HDFC Bank)

· In conclusion- don't click on links from texts that claim to be from your bank, and don't believe anyone who says they're from your bank from an unknown number over the phone.

· Stay safe and always check with your bank in case of threatening texts or calls.

The above information was collated from a post by CA Lavanya Mohan with her permission. She has also blogged about the same on https://pennmoney.com/blog/how-to-detect-scam/

Comments

Manoj

12 Mar, 2023

very useful article

Post a comment